How Much Home Can You Afford If You're Paying $2,000 in Rent?

If you're currently renting in the Hampton Roads Area, you might be surprised to learn just how close you are to affording a home of your own — especially if your rent is $1,800 or more.

While every situation is different, it’s worth asking: If I’m already paying $2,000/month, what could that translate to if I were buying instead?

Mortgage vs. Rent — A Simple Comparison

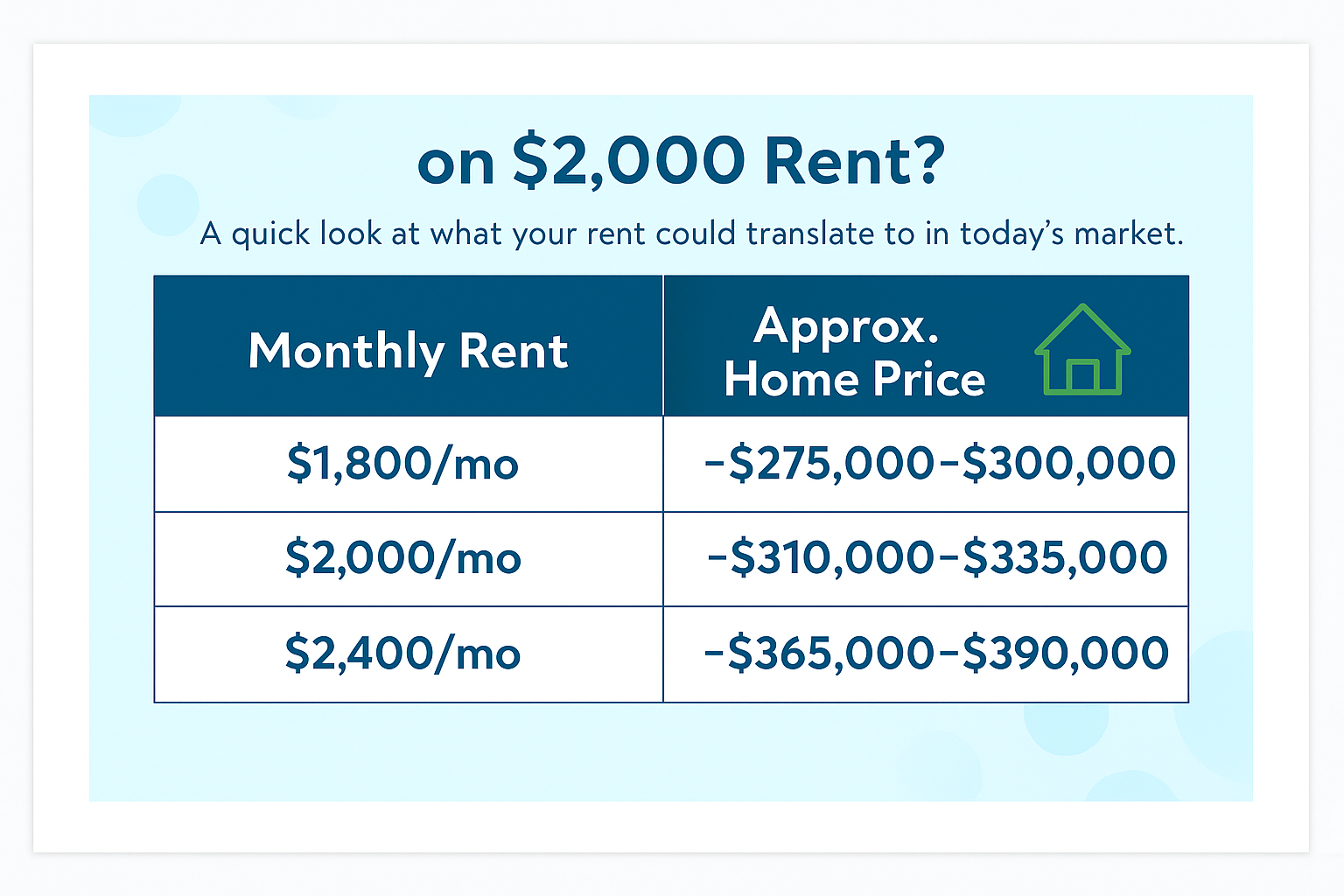

Here’s a rough breakdown of what a $2,000 monthly rent payment might equate to if you were buying a home:

Monthly Payment | Approx. Home Price | Assumptions |

$1,800/mo | ~$275,000–$300,000 | 7.0% rate, 3%–5% down |

$2,000/mo | ~$310,000–$335,000 | Same assumptions |

$2,400/mo | ~$365,000–$390,000 | Same assumptions |

These estimates include property taxes, insurance, and mortgage insurance where applicable — though your exact numbers may vary.

💡 Tip: Your rent might already cover more than you think — and with a fixed-rate mortgage, that payment won’t increase every year like rent often does.

What Impacts How Much You Can Afford?

Even if your rent is on the higher side, lenders still look at a few key things to determine what you qualify for:

- Your credit score (600+ often works with first-time buyer programs)

- Your debt-to-income ratio (how much you owe vs. how much you earn)

- Down payment (some programs allow 1%–3% down)

- Job history (2 years of stable income is common)

If you’re not sure where you stand, that’s okay — many renters aren’t. The key is to get a sense of your numbers so you can plan ahead, even if you’re still renting today.

Want to Know Your Number?

Kim works closely with a local mortgage specialist who can run the numbers for you — even if you're just curious. It's free, it's private, and it might just open the door to owning a home.